![]() The Polish economy has grown steadily since 1992, at annual rates far above EU averages. In 2022, GDP growth was 5.3% and, on a purchasing power parity basis, per capita GDP is now above 80% of the EU average. Unemployment has fallen steadily over recent years, to 2.9% in 2022 – less than half the EU average. Poland’s population has been relatively stable over the last thirty years; emigration has been more than balanced by immigration from Ukraine.

The Polish economy has grown steadily since 1992, at annual rates far above EU averages. In 2022, GDP growth was 5.3% and, on a purchasing power parity basis, per capita GDP is now above 80% of the EU average. Unemployment has fallen steadily over recent years, to 2.9% in 2022 – less than half the EU average. Poland’s population has been relatively stable over the last thirty years; emigration has been more than balanced by immigration from Ukraine.

|

General data |

|

2022 |

|

Population |

million |

36.8 |

|

GDP |

€ billion |

654.6 |

|

Per capita GDP |

€/person |

17 800 |

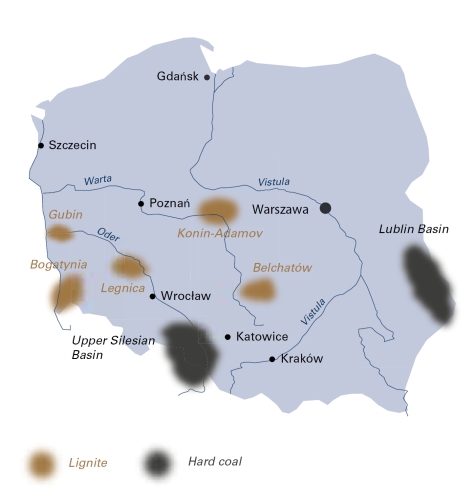

Coal is of strategic importance to the Polish economy. Compared with other EU member states, Poland has much larger reserves and makes good use of hard coal and lignite for electricity production with a 70.5% share in 2022 (126.7 TWh). Hard coal reserves total 4.3 billion tonnes, located mostly in the Upper Silesian and Lublin coal basins, while lignite reserves amount to 0.8 billion tonnes with a further 23.1 billion tonnes of resources.

At 40.6%, Poland’s energy import dependency was well below the EU average of 57.1% in 2021. The country’s total primary energy supply in 2022 was dominated by coal (42.1%), with oil (30.2%) and gas (14.5%) also taking significant shares, followed by biofuels and waste (10.8%), solar PV and wind (2.4%), and hydro (0.2%).

In 2022, total gross power generation was 179.7 TWh. Polish electricity exports have declined since 2015 and in 2022 Poland was a net exporter of 1.7 TWh. 78.9 TWh or 43.9% of Polish electricity production was generated at hard coal-fired power plants or from coal gases at coking works and steel plants. 47.8 TWh were generated at lignite-fired power plants, a 26.6% share. Power generated from wind grew to 19.8 TWh (11.0%); solar PV has grown strongly and accounted for 4.6% in 2022. Fossil gas (6.3%), oil (1.3%), biofuels (3.3%), hydro (1.1%) and waste were the other sources of electricity. In total, renewable energy sources had a 20.1% share of power generation.

Over recent years, Poland has commissioned the last of its coal- and lignite-fired power plants: PGE Opole units 5 and 6 (2 × 900 MW) in 2019, TAURON Jaworzno III (910 MW) in 2020 and the 490 MW lignite-fired unit 11 at the PGE Turów power station in 2021. With an otherwise ageing fleet and stricter EU emission standards, these new plants replaced older ones. In line with EU climate policy, the Polish government in September 2020 signed a social agreement with trade unions to phase out coal mining by 2049.

In the Energy Policy of Poland to 2040 (PEP2040), published in November 2019 and adopted in February 2021, output from coal and lignite plants was expected to remain relatively stable, falling only slightly to 113 TWh in 2030 to take a reduced, 56% share of a larger market. Renewables are forecast to grow to take a 32% share with the balance from new nuclear and gas-fired power plants.

For economic reasons, the government plans a restructuring of the coal and lignite sector. In April 2021, the State Treasury announced a plan to create the new National Energy Security Agency (NABE). This would integrate the coal and lignite assets of PGE, ENEA, ENERGA and TAURON POLSKA ENERGIA. PGE GiEK would have a special role as integrator. After this restructuring, NABE would own all lignite-fired power plants, related lignite mines, and all hard coal-fired power plants – so 55% of Polish electricity generation capacity – but no hard coal mines or district heating plants. Following national elections in October 2023, negotiations on the industry restructuring are expected to resume under the newly formed government.

Poland has no nuclear power generation, but operates one 30 MWth experimental reactor at Świerk-Otwock near Warsaw. PEP2040 calls for Poland to obtain 23% of its energy from renewable sources by 2030 with more solar PV and wind power, especially from the Baltic Sea, and the commissioning in 2033 of Poland’s first nuclear power plant at Lubiatowo-Kopalino or Zarnowiec in Pomerania, northern Poland, followed by more units to reach 9 GW for a total investment of PLN 140 billion (€32 billion). First contracts have been signed between a state-owned special purpose vehicle and US partners WESTINGHOUSE and BECHTEL for three AP1000 reactors, while in October 2022, KOREA HYDRO AND NUCLEAR POWER COMPANY (KHNP) signed a letter of intent with PGE and ZE PAK Group to replace existing lignite-fired power units at Pątnów with an APR1400 reactor, also by 2033. In April 2023, PGE and ZE PAK announced a PGE PAK ENERGIA JĄDROWA joint venture to develop the Pątnów nuclear plant.

Hard coal

Exploitable hard coal reserves are located in Upper Silesia and in the Lublin basin in the east of Poland, with the Upper Silesian coalfield accounting for 89.7% of the total. The coal reserves in this region contain some 400 coal seams with thicknesses of 0.8 metres to 3.0 metres. About half of these seams are economically workable.

More than half (58.6%) of Polish hard coal reserves are steam coal and 41.4% coking coal. All hard coal is deep mined at an average working depth of around 600 metres, with some mines over 1 000 metres. Mining is fully mechanised: over 90% of production is by longwall systems.

Since the beginning of the 1990s, the Polish mining industry has been going through a process of transformation. Hard coal production decreased from 177.4 million tonnes in 1989 to 52.8 million tonnes in 2022. Over the same period, employment in the Polish hard coal mining sector decreased from 407 000 to 72 911 employees at the end of 2022.

Despite the significant reduction of mining capacity over three decades, Poland remains by far the largest hard coal producer in Europe. The largest coal mining company, the Polish Mining Group (PGG – POLSKA GRUPA GÓRNICZA) was established in May 2016 to replace its predecessor, KOMPANIA WĘGLOWA (KW). PGG operates seven mines: KWK ROW (Chwałowice, Jankowice, Marcel and Rydułtowy mines), KWK Ruda (Bielszowice and Halemba mines), KWK Piast-Ziemowit, KWK Bolesław Śmiały, KWK Sośnica, KWK Staszic-Wujek and KWK Mysłowice-Wesoła. At the end of 2022, the company employed a total of 36 800 people.

Other leading coal mining companies are JASTRZĘBSKA SPÓŁKA WĘGLOWA (JSW) and LUBELSKI WĘGIEL „BOGDANKA” (LW „Bogdanka”). JSW is the EU’s largest coking coal producer, with an output of 11.0 million tonnes of coking coal and 3.1 million tonnes of steam coal in 2022. Following its earlier privatisation in 2009, a majority (65%) of the shares in LW „Bogdanka” were acquired in 2015 by ENEA, a Polish power utility company, and so the state has a majority shareholding.

Other, smaller coal hard coal producers include: TAURON WYDOBYCIE with three mines, BUMECH’s PG SILESIA mine, WĘGLOKOKS KRAJ with the Bobrek-Piekary mine, SILTECH mine, and the EKO-PLUS mine.

In 2022, steam coal output of 40.5 million tonnes accounted for the majority (76.6%) of hard coal production. Coking coal production reached 12.4 million tonnes, mainly by JSW.

Unprofitable mines or units of integrated mines have been transferred to SPÓŁKA RESTRUKTURYZACII KOPALŃ (SRK – Mines Restructuring Company) for their eventual closure. In 2022, there were ten mines in the decommissioning process managed by this restructuring company.

The Polish hard coal mining industry works to ensure the sector’s profitability. This entails new investment in modernisation, matching production volumes to market demand, reducing costs and increasing productivity. However, structural changes have continued in line with the decision in November 2016 of the European Commission to allow state aid for the closure of uncompetitive coal mines. The European Commission concluded that this support would not unduly distort competition. On 15 April 2019, the Commission approved changes to the state aid programme for the Polish coal sector for the period from 2015 to 2023. And more recently, in 2021, Poland notified an update to

the above-mentioned aid programme, including its extension to 2027.

Coal exporters and importers have an efficient infrastructure at their disposal in Poland, with cross-border rail links to neighbouring countries and to the Baltic Sea ports of Gdańsk, Szczecin-Świnoujście and Gdynia. Among these terminals, Gdańsk and Świnoujście can load capesize vessels. Hard coal exports from Poland totalled 5.4 million tonnes in 2022. Most of the shipments were transported overland to neighbouring EU member states, namely the Czech Republic, Slovakia, Austria, Germany and Hungary, while small volumes were transhipped via the Baltic ports.

In 2022, WĘGLOKOKS exported 0.9 million tonnes of

hard coal.

In 2022, hard coal imports reached a record 20.2 million tonnes, including 3.0 million tonnes of coking coal. The largest supplier was South Africa (3.4 million tonnes), with important quantities also from Australia (3.2 million tonnes), Kazakhstan (3.2 million tonnes), Colombia (2.7 million tonnes), Indonesia and other countries. Only 2.6 million tonnes were imported from Russia which had been the leading source of coal imports in previous years. From 16 April 2022 – ahead of the EU as a whole – Poland unilaterally banned the import of Russian energy raw materials into its territory. This decision was in response to Russian aggression against Ukraine and meant securing many new contracts with other coal exporters to Poland.

Irrespective of the large volume of coal imports in 2022, Poland aims to meet its demand for steam coal for power generation from domestic resources. Indigenous coal will be the foundation of Poland’s energy mix and a key element of its energy security. At the same time, the forecast increase in Polish power demand will be covered by sources other than conventional coal-fired power plants.

To expand the use of modern technologies, Główny Instytut Górnictwa – Państwowy Instytut Badawczy (GIG-PIB – the Central Mining Institute, a National Research Institute), the Poltegor Institute, Instytut Technologii Paliw i Energii (ITPE – Institute of Energy and Fuel Processing Technology) and Instytut Techniki Górniczej KOMAG (Institute of Mining Technology) undertake research, development and demonstration projects in co-operation with the coal and lignite mining industry. Notable projects, some supported by the EU Research Fund for Coal and Steel, include those aimed at methane management in underground coal mines and the ecological restoration of coal and lignite mine sites after mining has ceased.

Lignite

Poland exploits its lignite deposits exclusively at surface mines. Two are located in central Poland and a third lies in the southwest of the country. In 2022, lignite production was 54.6 million tonnes, 99% of which was used by mine-mouth power plants which generated 47.8 TWh of electricity or 26.6% of Poland’s total gross power generation.

![]() The Bełchatów lignite basin, situated in the central part of Poland, incorporates two lignite fields: Bełchatów and Szczerców. In 2022, the Bełchatów mine produced 41.2 million tonnes of lignite or three quarters of Poland’s total lignite production. Mining this lignite required the removal of about 96.3 million cubic metres of overburden, which equates to an overburden-to-lignite ratio of 2.3 cubic metres per tonne. The depth of mining operations in the Bełchatów field is about 300 metres and the average calorific value of the fuel is 8 070 kJ/kg. Bełchatów mine is expected to remain in operation until 2038. The lignite output is supplied entirely to the twelve units at a mine-mouth power station owned by PGE GiEK, with a total capacity of 5 298 MW – the largest in Europe. Electricity produced at this power station covers about 20% of national power demand. Built mainly between 1981 and 1988 and expanded with a new 858 MW unit in 2011, it generates the cheapest electricity in Poland.

The Bełchatów lignite basin, situated in the central part of Poland, incorporates two lignite fields: Bełchatów and Szczerców. In 2022, the Bełchatów mine produced 41.2 million tonnes of lignite or three quarters of Poland’s total lignite production. Mining this lignite required the removal of about 96.3 million cubic metres of overburden, which equates to an overburden-to-lignite ratio of 2.3 cubic metres per tonne. The depth of mining operations in the Bełchatów field is about 300 metres and the average calorific value of the fuel is 8 070 kJ/kg. Bełchatów mine is expected to remain in operation until 2038. The lignite output is supplied entirely to the twelve units at a mine-mouth power station owned by PGE GiEK, with a total capacity of 5 298 MW – the largest in Europe. Electricity produced at this power station covers about 20% of national power demand. Built mainly between 1981 and 1988 and expanded with a new 858 MW unit in 2011, it generates the cheapest electricity in Poland.

In the Turoszów lignite basin, located in southwest Poland, reserves are estimated at 261 million tonnes. In 2022, Turów mine produced 9.9 million tonnes of lignite with a calorific value of 9 500 kJ/kg to supply the seven units at the 2 029 MW PGE GiEK Turów power station. From 2019 to 2021, units 1, 2 and 3 were modernised, increasing the capacity of each unit from 235 MW to 250 MW, while units 4, 5 and 6 are each 261 MW. In 2021, a new, 496 MW unit was put into operation. In 2022, approximately 21.5 million cubic metres of overburden were removed, giving a stripping ratio of 2.2 cubic metres per tonne. Turów mine is expected to be in operation until 2045.

The Bełchatów and Turów lignite mines, as well as the adjacent power plants, belong to PGE GÓRNICTWO I ENERGETYKA KONWENCJONALNA (PGE GiEK), one of the seven companies in the majority state-owned Polish utility POLSKA GRUPA ENERGETYCZNA (PGE Capital Group). Headquartered in Bełchatów, PGE GiEK has operations in four voivodships. It is the leader in Polish lignite mining, with a share of 94% of total production, and is the biggest electricity producer in Poland, satisfying over 40% of national power demand.

The Pątnów-Adamów-Konin (PAK) lignite basin, located in central Poland between Warsaw and Poznań, has been producing lignite for over fifty years and accounted for around 5% of total Polish lignite production in 2022. The only active mining site in the PAK basin is the Konin mine belonging to ZESPÓŁ ELEKTROWNI PĄTNÓW-ADAMÓW-KONIN (ZE PAK Group) which was listed on the Warsaw stock exchange in October 2012. ZE PAK Group’s mining assets are now concentrated in PAK KWB Konin SA which operates three mines: Tomisławice, Drzewce and Jóźwin II B (in the Pątnów IV field) that together produced 3.0 million tonnes of lignite in 2022, requiring the removal of 20.4 million cubic metres of overburden (a stripping ratio of 6.8 cubic metres per tonne). Working depths are between 25 metres and 80 metres. The extracted fuel has an average calorific value of 9 220 kJ/kg and is supplied to two mine-mouth power plants: Pątnów I with an installed capacity of 1 244 MW and Pątnów II (474 MW). The lignite units at Konin power plant have closed and, after conversions completed in 2012 and 2020, two 50 MW biomass units now operate. ZE PAK Group intends to cease lignite mining before 2025 and in August 2022 ended its mining operations at the Drzewce mine.

PAK KWB Adamów SA operated three surface mines, namely Adamów, Władysławów and Koźmin. All of these are now closed, the last in early 2021. In November 2023, ZE PAK Group and a consortium led by SIEMENS ENERGY agreed to build a 600 MW combined-cycle gas turbine (CCGT) plant at the Adamów site. This PLN 2.3 billion investment should be operational by early 2027.

The Sieniawa 2 lignite deposit in the Lubusz Voivodeship is exploited by the private company KWB SIENIAWA. In 2022, 531 thousand tonnes of lignite were mined, an increase of 47.9% compared with 2021.

The average productivity at Poland’s lignite mines was 7 700 tonnes per man-year in 2022 and employment totalled 6 980 people. Poland’s lignite mining areas can maintain their annual output at current levels of around 60 million tonnes; lignite is expected to play a stable and important role in Poland’s energy supply until at least 2030. The Złoczew deposit has 611 million tonnes of exploitable reserves while the Ościsłowo deposit has 50 million tonnes and both are considered prospective by the government in its strategic forecast to 2040. A much larger deposit of 1 624 million tonnes lies at Gubin.

Poland

|

Coal production, reserves * and resources * |

2022 |

|

|

Hard coal saleable output |

Mt |

52.8 |

|

Hard coal reserves |

Mt |

4 266 |

|

Hard coal total resources |

Mt |

64 616 |

|

Lignite saleable output |

Mt |

54.6 |

|

Lignite reserves |

Mt |

819 |

|

Lignite total resources |

Mt |

23 085 |

|

Saleable coal quality |

|

|

|

Hard coal net calorific value |

kJ/kg |

28 815 |

|

Hard coal ash content |

% a.r. |

16.7 |

|

Hard coal moisture content |

% a.r. |

10.0 |

|

Hard coal sulphur content |

% a.r. |

0.74 |

|

Lignite net calorific value |

kJ/kg |

7 400 ‑ 10 300 |

|

Lignite ash content |

% a.r. |

6.0 ‑ 12.0 |

|

Lignite moisture content |

% a.r. |

50.0 ‑ 60.0 |

|

Lignite sulphur content |

% a.r. |

0.2 ‑ 1.1 |

|

Coal imports / (exports) |

|

2022 |

|

Hard coal |

Mt |

20.2 / (5.4) |

|

Lignite |

Mt |

0.3 / (0.0) |

|

Primary energy production |

|

2022 |

|

Total primary energy production |

Mtce |

84.8 |

|

Hard coal production |

Mt / Mtce |

52.8 / 43.5 |

|

Lignite production |

Mt / Mtce |

54.6 / 15.4 |

|

Primary energy consumption |

|

2022 |

|

Total primary energy supply |

Mtce |

148.0 |

|

Hard coal consumption |

Mt / Mtce |

65.5 / 54.2 |

|

Lignite consumption |

Mt / Mtce |

54.8 / 15.4 |

|

Power supply |

|

2022 |

|

Total gross power generation |

TWh |

179.7 |

|

Net power imports (exports) |

TWh |

(1.7) |

|

Total power supply |

TWh |

163.6 |

|

Power generation from hard coal |

TWh |

78.9 |

|

Power generation from lignite |

TWh |

47.8 |

|

Hard coal power generation capacity |

MW net |

20 925 |

|

Lignite power generation capacity |

MW net |

7 597 |

|

Employment |

2022 |

|

|

Direct in hard coal mining |

number |

72 911 |

|

Direct in lignite mining and generation |

number |

6 980 |

* Source: Państwowy Instytut Geologiczny – Państwowy Instytut Badawczy (PIG-PIB – the Polish Geological Institute, a National Research Institute) as at 31 December 2022