![]() Since the global economic crisis of 2008, the Bulgarian economy has grown steadily, by up to 7% per year. In 2022, GDP growth was 3.9% and the unemployment rate was 2.7%. The national currency is pegged to the euro at a rate of 1.96 leva and Bulgaria intends to introduce the euro within the coming years which should further increase the country’s attractiveness for foreign direct investment.

Since the global economic crisis of 2008, the Bulgarian economy has grown steadily, by up to 7% per year. In 2022, GDP growth was 3.9% and the unemployment rate was 2.7%. The national currency is pegged to the euro at a rate of 1.96 leva and Bulgaria intends to introduce the euro within the coming years which should further increase the country’s attractiveness for foreign direct investment.

|

General data |

|

2022 |

|

Population |

million |

6.4 |

|

GDP |

€ billion |

85.8 |

|

Per capita GDP |

€/person |

13 300 |

The Bulgarian mining industry is in a period of uncertainty and change as it faces the challenges of achieving the EU’s ambitious decarbonisation targets. Nevertheless, with its large resource potential, the mining sector has been able to modernise by implementing environmental measures and investing in energy efficiency programmes. Priority investments are directed towards high-tech solutions and energy efficiency, all in compliance with the environmental requirements and standards of national and EU legislation.

In January 2023, the Bulgarian Ministry of Energy published a Strategic Vision for Sustainable Development of the Energy Sector of the Republic of Bulgaria 2023-2053. This envisages a phase-out of electricity production from coal and lignite by 2038, increased production from renewables and the roll out of electricity storage technologies. Based on this vision, the Bulgarian government is elaborating a new energy policy strategy to 2030 with a horizon to 2050. In September 2023, the government submitted territorial just transition plans for three coal mining regions to the European Commission. These were approved in December 2023.

Primary energy production totalled 19.3 million tonnes of coal equivalent in 2022, with lignite and brown coal having the highest share at 43.7%, followed by nuclear energy (31.9%) and renewables (22.9%). Non-renewable waste (0.8%), fossil gas (0.1%) and other sources accounted for the balance. Bulgaria’s overall energy import dependency was 36.3% in 2021, far below the EU average of 57.1%.

Bulgaria has a diverse power generation mix, including conventional nuclear and thermal plants, alongside renewable energy sources (hydro, wind, solar and biomass). The power generation mix is dominated by thermal power plants using coal, followed by the 2 GW Kozloduy nuclear power plant on the Danube. Two new reactors are planned which would double the capacity of Bulgaria’s only nuclear power plant. Gross electricity generation in 2022 was 50.5 TWh, 6.2% more than in 2021. The Bulgarian state uses the potential of indigenous coal to its maximum extent and in compliance with all environmental requirements. Thermal power plants using locally mined coal provided 43.1% of electricity production in 2022, a year when only thermal power generation grew – by 22.1% – while hydro and nuclear output fell.

MINI MARITSA IZTOK EAD (MMI) operates the largest lignite coal field in Bulgaria to supply lignite to thermal power plants for electricity generation and a briquetting plant. Brown coal is also mined in the Pernik and Bobovdol basins.

Saleable coal output in 2022 was 35.5 million tonnes, 25.5% more than in 2021. Most of the coal now produced in Bulgaria is classified as lignite (98%) and the remainder is brown coal (2%).

The Bulgarian energy sector is important for the country’s energy-intensive industries and accounts for above EU‑average shares in total employment and value added. The sector contributes to the socio-economic development and welfare of the coal mining municipalities.

Large investments in new capacity, the rehabilitation of old power plants and expansion of the electricity grid in recent years have allowed Bulgarian consumers to benefit from

reliable and affordable electricity. However, for electricity utilities, the regulated consumer tariffs are insufficient to cover new investments or even the cost of allowances under the EU emissions trading system, a situation exacerbated by the high number of consumers in arrears.

Lignite

With a total mining area of 240 square kilometres at the Maritsa Iztok (or Maritsa East) complex, MINI MARITSA IZTOK EAD (MMI) operates the largest mining site in southeast Europe and is the largest employer in Bulgaria. Lignite is mainly extracted in opencast mines where the total production of 34.3 million tonnes in 2022 was 104% of the production target. Including contracted quantities, the company delivered 15.5 million tonnes to the 1 620 MW Maritsa East 2 power plant owned by BULGARIAN ENERGY HOLDING, 9.9 million tonnes to the CONTOURGLOBAL 908 MW Maritsa East 3 power plant, 6.0 million tonnes to the AES 690 MW Galabovo power plant and 2.5 million tonnes to “BRICKEL” EAD for briquetting. A further 0.5 million tonnes were exported to Serbia. This was the first time in its 71-year history that MMI had exported coal outside the territory of its Maritsa Iztok complex.

The sale of Bulgarian coal outside the country is a major achievement for MMI and offers good prospects. In 2022, a contract was signed with the Serbian company VIROM GROUP to export 1.75 million tonnes of lignite to power plants near Belgrade at a price higher than that for deliveries to power plants in the Maritsa Iztok complex.

As a subsidiary of BULGARIAN ENERGY HOLDING, MMI plays an important role in ensuring national energy security. In the next few years, lignite produced by MMI will be used exclusively for thermal power generation whose share in the generation mix will remain stable. As there is no alternative to lignite in the immediate future, no significant reduction in lignite production or lignite-fired power generation is foreseen. Under the various new energy strategy scenarios, a decrease in lignite-fired power generation and consequent capacity closures are forecast after 2030 or when the new nuclear units are commissioned.

The selling price of lignite mined by MMI, despite being the lowest in the EU, will most probably remain unchanged in the years ahead. This has a negative impact on the company’s ability to invest. Hence, the company will rely on European investment funds for its future development projects, including diversification projects such as a solar PV park on the spoil tip of a mine.

Private lignite mining companies accounted for small shares of national lignite production in 2022: STANYANTSI AD (0.7%) and BELI BRYAG AD (0.6%).

Brown coal

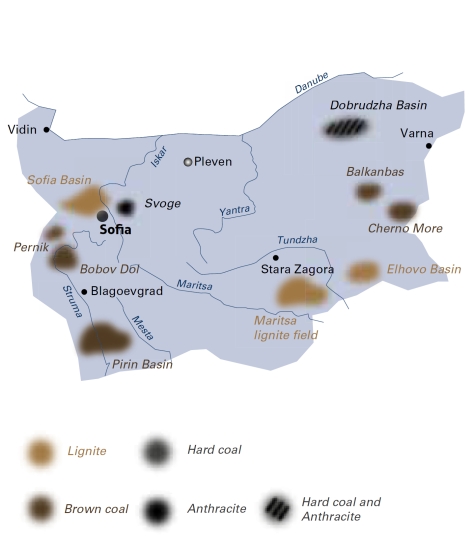

Bulgaria’s brown coal deposits are mostly located in the western part of the country (the Bobov Dol, Pernik and Pirin coalfields and the Katrishte deposit) and near the Black Sea (the Cherno More coalfield where production ceased in 2016). In 2022, the production of brown coal accounted for 2% of total coal production. Two thirds were mined in the Bobov Dol basin and one third in the Pernik basin by two small private mining companies: VAGLEDOBIV BOBOV DOL EOOD and MINI OTKRIT VAGLEDOBIV EAD.

Bulgaria

|

Coal production, reserves and resources |

2022 |

|

|

Brown coal saleable output |

Mt |

0.7 |

|

Brown coal reserves |

Mt |

190 |

|

Brown coal total resources |

Mt |

4 110 |

|

Lignite saleable output |

Mt |

34.8 |

|

Lignite reserves |

Mt |

2 089 |

|

Lignite total resources |

Mt |

4 489 |

|

Saleable coal quality |

|

|

|

Brown coal calorific value |

kJ/kg |

12 140 ‑ 13 400 |

|

Brown coal ash content |

% a.r. |

<26 |

|

Brown coal moisture content |

% a.r. |

<16 |

|

Brown coal sulphur content |

% a.r. |

<2.7 |

|

Lignite calorific value |

kJ/kg |

5 652 ‑ 7 746 |

|

Lignite ash content |

% a.r. |

17 ‑ 45 |

|

Lignite moisture content |

% a.r. |

51 ‑ 60 |

|

Lignite sulphur content |

% a.r. |

2.2 ‑ 2.8 |

|

Coal imports / (exports) |

|

2022 |

|

Hard coal |

Mt |

1.3 / (0.0) |

|

Lignite |

Mt |

0.0 / (0.5) |

|

Primary energy production |

|

2022 |

|

Total primary energy production |

Mtce |

19.3 |

|

Brown coal and lignite production |

Mt / Mtce |

35.5 / 8.4 |

|

Primary energy consumption |

|

2022 |

|

Total primary energy supply |

Mtce |

27.6 |

|

Hard coal consumption |

Mt / Mtce |

0.7 / 0.5 |

|

Lignite consumption |

Mt / Mtce |

35.1 / 8.4 |

|

Power supply |

|

2022 |

|

Total gross power generation |

TWh |

50.5 |

|

Net power imports (exports) |

TWh |

(12.2) |

|

Total power supply |

TWh |

33.7 |

|

Power generation from hard coal |

TWh |

0.3 |

|

Power generation from lignite |

TWh |

21.8 |

|

Hard coal power generation capacity |

MW net |

356 |

|

Lignite power generation capacity |

MW net |

4 119 |

|

Employment |

2022 |

|

|

Direct in brown coal and lignite mining |

number |

7 075 |

|

Direct in coal and lignite power generation |

number |

4 275 |