![]() The war of aggression against Ukraine by the Russian Federation has devasted a peaceful country that was enjoying a period of impressive economic growth. The costs of war and the occupation of large parts of its territory mean that Ukraine’s GDP shrank by 30.3% in 2022, despite foreign currency inflows and assistance from Western partners. An exchange rate freeze helped curb inflation. At the end of 2022, the unemployment rate was 28.3% or 4.5 million people, while 11.7 million had migrated abroad, including some skilled workers and professionals.

The war of aggression against Ukraine by the Russian Federation has devasted a peaceful country that was enjoying a period of impressive economic growth. The costs of war and the occupation of large parts of its territory mean that Ukraine’s GDP shrank by 30.3% in 2022, despite foreign currency inflows and assistance from Western partners. An exchange rate freeze helped curb inflation. At the end of 2022, the unemployment rate was 28.3% or 4.5 million people, while 11.7 million had migrated abroad, including some skilled workers and professionals.

|

General data |

|

2022 |

|

Population (including refugees) |

million |

41.0 |

|

GDP |

€ billion |

151.5 |

|

Per capita GDP |

€/person |

4 700 |

Since the 19th century, Ukraine has been an important centre of heavy industry in Eastern Europe, notably the coal, steel and non-ferrous metals industries of the Donbas region. Despite partial occupation since 2014 and the destruction of industrial facilities – including coal mines, power plants and, during summer 2022, the massive Azovstal steelworks – a significant industrial base remains elsewhere in the country. Government loans and credit lines have helped companies restore damaged power generation and transmission infrastructure, but the destruction by Russia of, for example, the 335 MW Kakhovka hydropower plant in June 2023 is irreparable.

Faced with systematic, large-scale attacks on its power infrastructure since the fourth quarter of 2022, electricity generation from the country’s four nuclear power plants has been crucial, accounting for over half of the estimated 112.7 TWh total generation. The 6 000 MW Zaporizka NPP is the largest, with six of the country’s fifteen VVER reactors, but is occupied by Russian forces and under constant threat – cooling water from the Kakhovka reservoir has been lost. In 2021, nuclear accounted for 86.2 TWh or 57.5% from plants owned by ENERGOATOM which is set in 2023 to become an independent, but still 100% state-owned, joint-stock company. Coal was the second most important electricity source, at 37.0 TWh (24.7% of 150.0 TWh total generation in 2021), followed by gas at 9.9 TWh (6.6%), hydro (6.9%), wind (1.9%) and solar (1.7%), with oil and biomass together accounting for less than 1%. New renewables capacity (wind, solar PV, biomass and small hydro) was 9.9 GW prior to the Russian invasion and while a quarter is damaged or non-operational, new wind capacity continues to be built such as the 498 MW Tіlіgulska wind farm near Mykolaiv in southern Ukraine. By 2030, renewables capacity could grow to 30 GW. At the same time, it is likely that EU emission limits assumed in the National Emission Reduction Plan will have to be relaxed at existing thermal plants as investment in pollution control equipment is impossible under martial law.

In March 2022, the Moldovan and Ukrainian power systems were desynchronised from the Russian-dominated IPS/UPS grid and connected to the synchronous grid of Continental Europe. By March 2023, the transmission capacity had increased to 850 MW from Poland/Romania to Moldova/Ukraine and 400 MW in reverse.

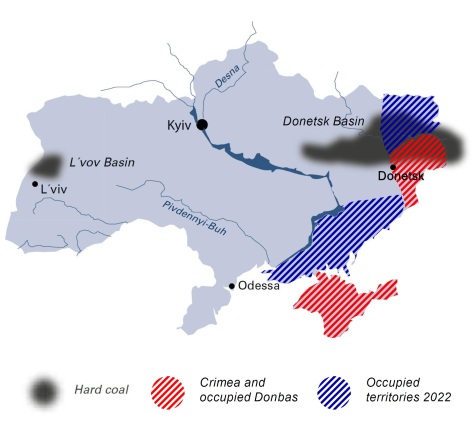

Ukraine has considerable reserves of coal and lignite, estimated at 32.0 billion tonnes in the Donetsk coal basin (by far the most significant), the Dnipro and Lviv-Volyn coal basins, as well as the Dnipro-Donetsk and Transcarpathian coal basins. It ranks sixth in the world after the United States, China, India, Australia and Russia in terms of proven hard coal reserves of which steam coal accounts for 70% and coking coal 30%. Exploitable reserves are competitive with imported coal.

The country also has large gas reserves estimated at over one trillion cubic metres – second only to Norway in Europe. These lie onshore, mainly in the Dnipro-Donetsk basin, offshore under the Black Sea, and as shale gas in the Donetsk and Kharkiv oblasts (Yuzivska gasfield) and in the Lviv and Ivano-Frankivsk oblasts (Olesska gasfield). Efforts to exploit these reserves were set back by the war, but a programme of deep drilling at the Machukhske gasfield in the Poltava oblast promises gas from almost 6 000 metres, adding to other conventional, shallower production which totalled 17.5 bcm in 2022.

In April 2023, the Cabinet of Ministers approved a new Energy Strategy 2050 which aims to develop nuclear power generation for a 50% share and renewables for the other 50% to achieve carbon neutrality in the energy sector by 2050.

Hard Coal

Hard coal deposits in Ukraine are characterised by their great depth – operations take place at 500 to 1 000 metres – and by thin seams of 0.8 to 1.0 metre. In 2018, coal was mined at forty-seven mines, of which forty-two produced G‑grade bituminous coal. The rest produced K‑grade coking coal and Zh‑grade bituminous coal.

Total run-of-mine coal production in 2022 was 26.1 million tonnes (saleable production is reported in the table below), with 17.5 million tonnes from the mines of Ukraine’s largest private energy company, DTEK. Other private mines produced 6.4 million tonnes while state-owned mines had an output of 2.2 million tonnes. Of these three groups, only DTEK managed to increase production since Russia’s full-scale invasion.

Since spring 2014, Russia’s invasion left Ukraine with little control over its coal-mining assets in the occupied territories of Donetsk and Luhansk oblasts where all anthracite mines are located. Production data for the lost coal mines in Donbas is not known, but some coal is likely exported via Russia and Georgia’s breakaway region of Abkhazia. In response, the consumption of G‑grade coal has grown as power plants designed for anthracite (A/T grade) have been converted to use G‑grade coal whose production is less at risk from hostilities.

Since the start of the war in 2014, Ukraine became a hard coal importer. In 2022, 4.7 million tonnes were imported: 2.9 million tonnes of coking coal and 1.8 million tonnes of steam coal. Ukraine currently bans the export of thermal coal for security reasons.

DTEK operates four thermal power plants: the 510 MW Dobrotvirska power plant, the 1 200 MW Ladyzhinska power plant, the 2 181 MW Burshtynska power plant and the 1 532 MW Kurakhivska power plant which has been heavily damaged by shelling. The company lost control over the Luhanska and Zaporizka coal power plants which are in the occupied territories, but still controls two coal-fired power plants using G and A/T grade coal: the 610 MW Prydniprovska power station and the 915 MW Kryvorizka power plant. State-owned CENTRENERGO also owns two coal-fired power plants using G and A/T grade coal: the 1 700 MW Zmiivska power plant (only one unit operating) and the 1 225 MW Trypilska power plant which does not operate as of 2023 due to heavy damage. The third coal plant operator, DONBASENERGO had to close its single 880 MW Slovianska coal power plant due to war damage.

Coal is sold under contract by mining enterprises to consumers, and through DERZHVUGLEPOSTACH which was established by the government to trade coal produced at state-owned coal mines. The bulk of the saleable output from state-owned coal mines is distributed at fixed prices.

Thus, loss-making mines are cross-subsidised by profitable mines, although losses are not fully covered. The 2022 budget envisaged financial support for Ukraine’s state-run mines of UAH 3.2 billion under the Coal Industry Restructuring programme and UAH 1.0 billion under a liquidation programme for uncompetitive coal mining companies. Private companies sell coal at market-based prices determined by supply and demand, having regard to international coal market prices.

Lignite

During the 1990s, Ukraine produced 35 million tonnes of lignite from the Olexandria and Mokra Kalyhirka deposits in the Kirovohrad and Cherkasy oblasts near the Dnipro River. Production in recent years has been minimal or zero.

Ukraine

|

Coal production, reserves and resources |

2022 |

|

|

Hard coal saleable output |

Mt |

21.2 |

|

Hard coal reserves |

Mt |

32 039 |

|

Hard coal total resources |

Mt |

81 045 |

|

Lignite saleable output |

Mt |

– |

|

Lignite reserves |

Mt |

2 336 |

|

Lignite total resources |

Mt |

7 717 |

|

Saleable coal quality |

|

|

|

Hard coal net calorific value |

kJ/kg |

19 250 ‑ 28 500 |

|

Hard coal ash content |

% a.r. |

5.0 ‑ 35.0 |

|

Hard coal moisture content |

% a.r. |

5.0 ‑ 16.0 |

|

Hard coal sulphur content |

% a.r. |

0.8 ‑ 5.0 |

|

Coal imports / (exports) |

|

2022 |

|

Hard coal |

Mt |

4.7 / (0.7) |

|

Primary energy production |

|

2021 |

|

Total primary energy production |

Mtce |

78.1 |

|

Hard coal production |

Mt / Mtce |

23.0 / 17.3 |

|

Primary energy consumption |

|

2021 |

|

Total primary energy supply |

Mtce |

126.0 |

|

Hard coal consumption |

Mt / Mtce |

35.1 / 29.7 |

|

Power supply |

|

2022 |

|

Total gross power generation |

TWh |

112.7 |

|

Net power imports (exports) |

TWh |

(2.0) |

|

Total power supply |

TWh |

110.7 |

|

Power generation from hard coal |

TWh |

24.8 |

|

Hard coal power generation capacity |

MW net |

18 587 |

|

Employment |

|

2022 |

|

Direct in hard coal mining |

number |

58 809 |

|

Other coal-related * |

number |

6 882 |

* at DTEK coal-fired power plants