![]() The Romanian economy has grown strongly since 2005: GDP has trebled and forecasts point to continued growth boosted by low tax rates. Per-capita GDP is less than half the EU average, although much closer on a purchasing power parity basis. In 2022, the unemployment rate was 5.5%. Romania has significant energy resources, including coal, lignite, fossil gas and oil. Almost 70% of the country’s total primary energy supply is met from indigenous resources, well above the EU average of 42.9% in 2021. Coal and lignite accounted for 11.1% of energy supply in 2022.

The Romanian economy has grown strongly since 2005: GDP has trebled and forecasts point to continued growth boosted by low tax rates. Per-capita GDP is less than half the EU average, although much closer on a purchasing power parity basis. In 2022, the unemployment rate was 5.5%. Romania has significant energy resources, including coal, lignite, fossil gas and oil. Almost 70% of the country’s total primary energy supply is met from indigenous resources, well above the EU average of 42.9% in 2021. Coal and lignite accounted for 11.1% of energy supply in 2022.

|

General data |

|

2022 |

|

Population |

million |

19.1 |

|

GDP |

€ billion |

285.9 |

|

Per capita GDP |

€/person |

15 000 |

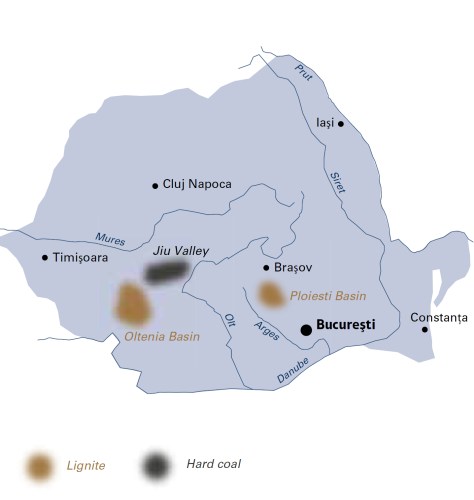

Hard coal resources are estimated at 2 446 million tonnes of which 11 million tonnes might be economically recoverable. Proven reserves of lignite total 280 million tonnes within 9 920 million tonnes of remaining resources. Of these, 95% lie in the Oltenia mining basin where more than 80% can be surface mined. The remaining lignite deposits have low economic potential and so extraction in most other areas has stopped. The country has a long coal mining tradition, stretching back over 150 years. Today, Romania’s entire hard coal and lignite output is used for heat and power generation.

The total net capacity of installed generation was 16 561 MW in 2022: coal and lignite 2 673 MW (16.1%), fossil gas 2 218 MW (13.4%), hydro 6 137 MW (37.1%), nuclear 1 300 MW (7.8%) and renewables 4 233 MW (25.6%), mostly wind turbines and solar PV. Peak demand in 2022 was 9 211 MW on 13 January, indicating a healthy generation margin.

In 2022, gross electricity production in Romania was 56.0 TWh: 25.0% from hydro, 19.8% from nuclear, 18.7% from coal and lignite, 18.7% from fossil gas and fuel oil, and 17.9% renewables and waste. Net electricity imports were 2.2 TWh in 2021 and reversed to 1.2 TWh net exports in 2022. Exports peaked at 11.2 TWh in 2015 but have since collapsed as the additional cost of allowances under the EU emissions trading system (ETS) has made non-EU power generation more competitive.

Romania’s first commercial nuclear reactor began operating in 1996 and a second CANDU reactor was commissioned in May 2007, thus completing two of the five reactors whose construction began in the 1980s and bringing the total gross capacity at the Cernavodă nuclear power plant to 1 413 MW. The completion of two further 720 MW reactors is planned by SOCIETATEA NATIONALA NUCLEARELECTRICA (SNN). It is government policy to construct these reactors by 2031 and refurbish the two existing units for a 30-year life extension.

Romania has established an energy policy framework in line with EU law to regulate the production of gas, coal, lignite, oil and nuclear energy, as well as the promotion of renewable energy sources. Indeed, Romania’s recovery and resilience plan foresees the phasing out of coal and lignite-fired electricity generation by 2032 to meet the requirements of the European Climate Law and related legislation.

In November 2018, the Romanian government published the Romanian Energy Strategy for 2019-2030 in view of 2050 with the stated priority of maintaining a diversity of indigenous energy sources. To that end, the government plans to stimulate investments in energy exploitation and infrastructure. It envisages the development of the national gas transmission system along the Bulgaria-Romania-Hungary-Austria (BRUA) corridor and the development, on Romanian territory, of the Southern Transmission Corridor for Black Sea gas. The utilisation of existing cross-border pipelines will be enhanced: with Ukraine to the northwest (Medieșul Aurit) and east (Isaccea), to the west with Hungary, to the south with Bulgaria and to the northeast with Moldova.

In its National Energy and Climate Plan, Romania sets a target to increase the overall share of renewables in gross final energy consumption to 30.7% by 2030 (in 2021, the share was 23.6%). It also aims, with energy efficiency measures, to restrict primary energy consumption in 2030 to 45.1% below earlier projections.

Lignite

COMPLEXUL ENERGETIC OLTENIA (CEO) or Oltenia Energy Complex is Romania’s largest producer of coal-based energy with an installed gross capacity of 2 295 MW. The company is responsible for 99% of national lignite production – 18.2 million tonnes in 2022. Its mines and power plants provide direct jobs for over 10 000 people.

Lignite mining has offered Romania a competitive advantage with the use of modern technologies and skilled labour to provide low-cost, baseload electricity. Reserves of lignite are concentrated in a relatively small area of 250 square kilometres where lignite is mined at ten surface mines. All these mines have scheduled closure dates.

■ Husnicioara and Lupoaia: 31 December 2022

■ Jilţ Sud and Nord: 31 December 2023

■ Tismana: 31 December 2024

■ Alunu, Berbeşti and Roşiuţa: 31 December 2025

■ Roşia-Peșteana and Pinoasa: 31 December 2030

Lignite mines provide a long-term, secure supply for the Turceni (990 MW) and Rovinari (990 MW) power plants owned by CEO. Further to the south lies the 315 MW CEO Ișalnița power plant, also lignite-fired, and the 300 MW Craiova II owned by SOCIETATEA ELECTROCENTRALE CRAIOVA. The cost of EU ETS emission allowances places a heavy burden on the operation of these plants – more than the combined costs of labour and fuel.

In January 2022, the European Commission approved state aid of up to €2.66 billion for CEO to restructure and diversify its energy mix with eight solar PV parks of 725 MW total capacity and two gas power plants (475 MW at SE Turceni and 850 MW at SE Ișalnița). In July 2023, contracts worth €995 million were agreed with TINMAR ENERGY and OMV PETROM for the solar parks and the Turceni CCGT plant. Financial support will come from the EU ETS Modernisation Fund – 70% of the investment costs for the PV parks and 50% for the Turceni gas plant – as well as from other public sources. The parks will be built on mine waste tips and power plant ash heaps. Also in the approved restructuring plan is flexibility for CEO to increase lignite production and delay some plant closures. Romania’s energy minister signed a similar agreement in June 2023 to replace the Craiova lignite plant with a 295 MW gas plant.

Hard coal

The COMPLEXUL ENERGETIC HUNEDOARA (CEH) or Hunedoara Energy Complex is a state-owned electricity and heat producer headquartered at Petroşani in the Southern Carpathians. In insolvency since 2019, CEH owns four underground hard coal mines in the Jiu Valley (Lonea, Livezeni, Vulcan and Lupeni which supply coal to the 150 MW Paroşeni and 1 075 MW Mintia-Deva power plants) and runs the Prestserv mines rescue station. The company accounts for less than 1% of Romanian electricity generation and had 2 045 employees at the end of 2022. An Iraqi company – MASS GROUP HOLDING – bought the Mintia-Deva site after the coal plant’s closure in July 2021 and plans to develop a large replacement gas plant. The Norwegian company ARBAFLAME proposes a biomass conversion for the Paroşeni plant.

Romania

|

Coal production, reserves and resources |

2022 |

|

|

Hard coal saleable output |

Mt |

– |

|

Hard coal reserves |

Mt |

11 |

|

Hard coal total resources |

Mt |

2 446 |

|

Lignite saleable output |

Mt |

18.2 |

|

Lignite reserves |

Mt |

280 |

|

Lignite total resources |

Mt |

9 920 |

|

Saleable coal quality |

|

|

|

Hard coal net calorific value |

kJ/kg |

14 200 ‑ 15 900 |

|

Hard coal ash content |

% a.r. |

37 ‑ 44 |

|

Hard coal moisture content |

% a.r. |

5.0 ‑ 7.4 |

|

Hard coal sulphur content |

% a.r. |

0.5 ‑ 1.8 |

|

Lignite net calorific value |

kJ/kg |

7 200 ‑ 8 200 |

|

Lignite ash content |

% a.r. |

30 ‑ 36 |

|

Lignite moisture content |

% a.r. |

40 ‑ 43 |

|

Lignite sulphur content |

% a.r. |

1.0 ‑ 1.5 |

|

Coal imports / (exports) |

|

2022 |

|

Hard coal |

Mt |

0.6 / (0.0) |

|

Lignite |

Mt |

0.0 / (0.2) |

|

Primary energy production |

|

2022 |

|

Total primary energy production |

Mtce |

31.8 |

|

Hard coal production |

Mt / Mtce |

0.0 / 0.0 |

|

Lignite production |

Mt / Mtce |

18.2 / 4.0 |

|

Primary energy consumption |

|

2022 |

|

Total primary energy supply |

Mtce |

45.1 |

|

Hard coal consumption |

Mt / Mtce |

0.6 / 0.5 |

|

Lignite consumption |

Mt / Mtce |

18.0 / 3.9 |

|

Power supply |

|

2022 |

|

Total gross power generation |

TWh |

56.0 |

|

Net power imports (exports) |

TWh |

(1.2) |

|

Total power supply |

TWh |

51.7 |

|

Power generation from hard coal |

TWh |

0.2 |

|

Power generation from lignite |

TWh |

10.3 |

|

Hard coal power generation capacity |

MW net |

176 |

|

Lignite power generation capacity |

MW net |

2 497 |

|

Employment |

2022 |

|

|

Direct in hard coal mining |

number |

2 045 |

|

Direct in lignite mining and generation |

number |

12 894 |