![]() Turkey is a large country with a population surpassed only by Germany in the European Union. GDP growth was around 7.3% in 2015 and averaged 5.5% from 2000 to 2015. The Ministry of Energy and Natural Resources (MENR) is responsible for the preparation and implementation of energy policies, plans and programmes in co‑ordination with its affiliated institutions and other public and private entities. It has statutory duties covering coal mines, power stations and the electricity grid.

Turkey is a large country with a population surpassed only by Germany in the European Union. GDP growth was around 7.3% in 2015 and averaged 5.5% from 2000 to 2015. The Ministry of Energy and Natural Resources (MENR) is responsible for the preparation and implementation of energy policies, plans and programmes in co‑ordination with its affiliated institutions and other public and private entities. It has statutory duties covering coal mines, power stations and the electricity grid.

|

General data |

|

2015 |

|

Population |

million |

77.7 |

|

GDP |

€ billion |

647.7 |

Total primary energy supply was 185.3 Mtce in 2015. With per-capita energy use in Turkey still comparatively low at 1.7 tonnes of oil equivalent (compared with an EU-average of 3.2 toe), energy demand is expected to grow rapidly due to the growing economy and the demographic impact of a young population.

Turkey’s indigenous energy resources consist almost exclusively of lignite and small amounts of hard coal. Together with coal imports, coal and lignite met 27.3% of total primary energy supply. At 30.2%, natural gas has the highest share in the energy mix, 99% imported. Oil accounted for 30.1% of energy supply in 2015, 89% imported. Overall, the country had an import dependency of 80% in 2015.

Turkey has large coal resources, in contrast to its limited oil and gas resources. The Turkish coal sector produced 1.5 million tonnes of hard coal and 41.8 million tonnes of lignite in 2015, this being 41.8% of total primary energy production and was used mostly for power generation. Coal imports have doubled since 2005 and stood at 31.5 million tonnes in 2015, again used mostly for power generation.

In total, Turkish coal-fired power plants had an installed capacity of approximately 15 200 MW at the end of 2015 (20.6% of total capacity). Hard coal-fired power plant installed capacity was 6 500 MW (8.8%) and the installed capacity using domestic lignite was 8 700 MW (11.8%). Turkey has embarked on an ambitious programme to build new power plants, some with the latest supercritical and circulating fluidised bed boiler technologies to burn mainly lignite and imported coal: Izdemir Enerji (350 MW), ICDAS Elektrik (600 MW) and Atlas Enerji (600 MW) started operations in 2014; Tufanbeyli Enerjisa (300 MW), Silopi (270 MW) and Bolu-Göynük 1 (135 MW) started operation in 2015; and Bolu-Göynük 2 (135 MW) started operation in 2016. All new power plants must comply with the EU Large Combustion Plants Directive (2001/80/EC).

Another 7 000 MW of coal-fired power plants are under construction, this being the largest such construction programme outside China and India. In 2015 alone, the Turkish government approved the construction of three new coal-fired power plants, that will increase capacity by 2 480 MW: Filiz Enerji was given approval for a 1 200 MW coal plant in Canakkale on the Aegean coast; Atakaş Energy received approval for a 680 MW power plant at İskenderun on the Mediterranean coast; and IC İçtaş Energy has permission for a 600 MW power plant near the city of Adana in the south of the country. In 2016, Tosyalı Electricity received approval for another 1 200 MW power plant at İskenderun.

In 2015, 72.1 TWh (27.8%) of Turkey’s gross electricity production of 259.7 TWh was generated from hard coal (15.2%) and lignite (12.5%). Of the remainder, 38.6% was provided by natural gas, 25.8% by hydropower, 0.8% by oil and the remaining 7.0% from waste, wind, geothermal and other renewable energy sources, including an insignificant quantity from solar. Turkey, through its Vision 2023 strategy that marks the 100th anniversary of the Republic, aims to increase its domestic electricity production by constructing new lignite-fired power plants and raising the shares of wind and geothermal power. Two new nuclear power plants are under construction with a combined capacity of 9 200 MW.

Turkish lignite production has doubled over the last ten years while hard coal production remained insignificant and heavily subsidised. Coal is extracted by three state-owned enterprises – TÜRKIYE KÖMÜR İŞLETMELERI (TKİ – Turkish Coal Enterprises), ELEKTRIK ÜRETIM (EÜAŞ – Electricity Generation Company) and TÜRKIYE TAŞKÖMÜRÜ KURUMU (TTK – Turkish Hard Coal Enterprises) – and a growing number of private companies, some under contract to the state-owned companies.

Hard coal

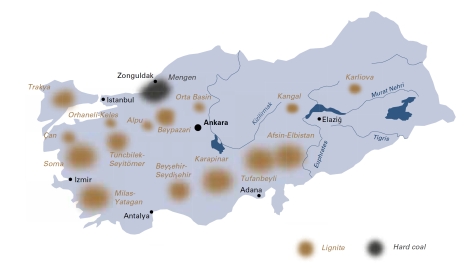

Turkey’s main hard coal deposits are located in the Zonguldak basin, between Ereğli and Amasra on the Black Sea coast in north-western Turkey. Hard coal resources in the basin are estimated at some 1.3 billion tonnes. The calorific value of hard coal reserves varies between 6 200 and 7 200 kcal/kg. This coal basin is the only region in Turkey where hard coal is extracted and it has a very complex geological structure which makes mechanised coal production almost impossible and requires labour-intensive coal production methods.

The state-owned TTK has a de-facto monopoly in the production, processing and distribution of hard coal, although there are no legal restrictions on private sector involvement. TTK operates five deep mines in the Zonguldak coal basin and produced approximately 1.5 million tonnes of saleable coal in 2015, supplying the 300 MW Catalağzı thermal power plant owned by Bereket Energy as well as other customers.

In 2015, Turkey also imported 31.5 million tonnes of hard coal for thermal power plants, steel production, industry and domestic heating purposes – one third from Russia, one third from Colombia and smaller quantities from South Africa (15%), Australia (8%) and elsewhere. Coal imports to Turkey are expected to continue to increase in the future.

At Silopi near the Iraqi border, the third unit of Ciner Group’s 405 MW asphaltite-fired power plant was commissioned in 2015 by China National Machinery Engineering Corporation.

Lignite

Lignite is Turkey’s most important indigenous energy resource, with proven reserves of 15.6 billion tonnes. Deposits are spread across the country, the most important one being the Afşin-Elbistan lignite basin of south-eastern Anatolia, near the city of Maraş where the economic reserves are estimated at around 7 billion tonnes. The Soma basin is the second-largest lignite mining area in Turkey. Other exploited deposits are located in: Muğla province with the Yeniköy lignite facility at Ören (Milas) and the South Aegean lignite facility at Yatağan; Kütahya province with the Seyitömer lignite facility at Seyitömer and the Tunçbilek mining centre at Tavşanlı; Çanakkale province with the Çan lignite facility; Bursa province with the Bursa lignite facility at Orhaneli; and Konya province with the Ilgın lignite facility. The quality of Turkish lignite is generally very poor and only around 5.1% of existing reserves have a heat content of more than 3 000 kcal/kg (12 500 kJ/kg). A project to explore new deposits was initiated in 2005. By 2015, 7.38 billion tonnes of new reserves had been proven.

The scale of Turkey’s surface mining operations allows lignite to be produced at a relatively low cost, making it competitive with imported energy resources. In 2015, lignite output totalled 41.8 million tonnes, far below the 59.6 million tonnes of 2014. Most of Turkey’s lignite production is from opencast mines. However, there are some underground mining activities, mainly in the Soma, Tunçbilek and Beypazarı basins. The drop in production in 2015 was due to the tragic accident at Soma mine in May 2014 and the subsequent safety measures taken across the mining industry.

TKİ is working in collaboration with TÜBİTAK, the Turkish Scientific and Technical Research Council, and other international partners on lignite drying and gasification research projects, some partly supported by the EU.

Turkey

|

Coal resources and reserves |

|

|

|

Total resources hard coal |

Mt |

1 300 |

|

Total resources lignite |

Mt |

16 000 |

|

Reserves hard coal |

Mt |

380 |

|

Reserves lignite |

Mt |

15 600 |

|

Primary energy production |

|

2015 |

|

Total primary energy production |

Mtce |

45.9 |

|

Hard coal (saleable output) |

Mt / Mtce |

1.5 / 1.2 |

|

Lignite (saleable output) |

Mt / Mtce |

41.8 / 14.0 |

|

Saleable coal quality |

|

|

|

Hard coal net calorific value |

kJ/kg |

26 000‑30 000 |

|

Lignite net calorific value |

kJ/kg |

8 665 |

|

Hard coal ash content |

% a.r. |

10.0‑15.0 |

|

Lignite ash content |

% a.r. |

11.0‑46.0 |

|

Hard coal moisture content |

% a.r. |

4.0‑14.0 |

|

Lignite moisture content |

% a.r. |

6.0‑55.0 |

|

Hard coal sulphur content |

% a.r. |

0.8‑1.0 |

|

Lignite sulphur content |

% a.r. |

0.2‑5.0 |

|

Coal imports / exports |

|

2015 |

|

Hard coal imports |

Mt |

31.5 |

|

Primary energy consumption |

|

2015 |

|

Total primary energy consumption |

Mtce |

185.3 |

|

Hard coal consumption |

Mtce |

33.2 |

|

Lignite consumption |

Mtce |

16.9 |

|

Power supply |

|

2015 |

|

Total gross power generation |

TWh |

259.7 |

|

Net power imports (exports) |

TWh |

4.4 |

|

Total power consumption |

TWh |

264.1 |

|

Power generation from hard coal |

TWh |

39.6 |

|

Power generation from lignite |

TWh |

32.6 |

|

Hard coal power generation capacity |

MW |

6 500 |

|

Lignite power generation capacity |

MW |

8 700 |

|

Employment |

|

2015 |

|

Direct in hard coal mining |

thousand |

15.668 |

|

Direct in lignite mining |

thousand |

28.856 |