![]() Türkiye is a candidate for EU membership and its economy benefits from access to the EU single market through the 1995 Customs Union agreement. Privatisation has created a buoyant energy sector. Total primary energy supply was 227.2 Mtce in 2021 with coal and lignite accounting for 25.6% – bringing diversity to an energy mix that was 72.4% dependent on net imports. With per-capita energy use in Türkiye still comparatively low at 1.9 tonnes of oil equivalent (toe) compared with an EU-average of 3.2 toe, energy demand is expected to grow with the economy.

Türkiye is a candidate for EU membership and its economy benefits from access to the EU single market through the 1995 Customs Union agreement. Privatisation has created a buoyant energy sector. Total primary energy supply was 227.2 Mtce in 2021 with coal and lignite accounting for 25.6% – bringing diversity to an energy mix that was 72.4% dependent on net imports. With per-capita energy use in Türkiye still comparatively low at 1.9 tonnes of oil equivalent (toe) compared with an EU-average of 3.2 toe, energy demand is expected to grow with the economy.

|

General data |

|

2022 |

|

Population |

million |

85.3 |

|

GDP |

€ billion |

862.3 |

|

Per capita GDP |

€/person |

10 100 |

The Ministry of Energy and Natural Resources (MENR) is responsible for the preparation and implementation of energy policies, plans and programmes in co‑ordination with its affiliated institutions and other public and private entities. It has statutory duties covering coal mines, power stations and the electricity grid.

Coal is the second most important source of electricity generation, at 31.0% in 2021; fossil gas-fired power plants contributed 32.3%, hydro 16.8%, wind 9.4% and solar PV 4.2%. Turkish coal-fired power plants had an installed capacity of 21.8 GW at the end of 2022 (21% of total). Hard coal-fired power plant capacity was 10.4 GW and the capacity using domestic lignite was 11.4 GW.

The first 1 200 MW unit at the Akkuyu nuclear power plant on the Mediterranean coast was inaugurated in April 2023; three more units should be completed there by 2026. The 4 800 MW Akkuyu plant is built, owned and operated by a Turkish subsidiary of ROSATOM and the state-owned electricity supplier EÜAŞ will buy around half its output under a 15‑year contract. The proposed 5 200 MW Sinop and 5 300 MW Igneada nuclear power plants, both on the Black Sea coast, would likely be based on other reactor designs.

Türkiye has the world’s sixth largest lignite reserves. Total coal resources are estimated at 1.3 billion tonnes of hard coal and 16.3 billion tonnes of lignite. Turkish lignite production and electricity generation from lignite and hard coal have increased steadily. Between 1990 and 2022, lignite production doubled while hard coal imports increased sixfold to 34.7 million tonnes. Turkish energy policy would see this trend continue, offering opportunities for foreign direct investment (FDI) in the modernisation and expansion of the Turkish coal sector. Coal is extracted by three state-owned enterprises – TÜRKIYE KÖMÜR İŞLETMELERI (TKİ – Turkish Coal Enterprises), ELEKTRIK ÜRETIM (EÜAŞ – Electricity Generation Company) and TÜRKIYE TAŞKÖMÜRÜ KURUMU (TTK – Turkish Hard Coal Enterprises) – and several private companies, some under contract to the state-owned companies.

Coal also plays a role in residential heating. The Turkish government distributes annual coal allowances to poorer households, even in regions with access to fossil gas.

Türkiye forecasts growing energy needs. Currently, almost all oil, gas and hard coal are imported (93%, 99% and 97% respectively) mostly from the Middle East and Russia, leading to a large trade deficit. Turkish energy policy focuses on boosting indigenous energy supply, modernising energy system infrastructure, and improving the functioning of the energy market. The Eleventh Development Plan 2019-2023 prioritises expanding lignite production and lignite-fired power generation, exploiting fossil gas reserves, constructing new nuclear power plants and deploying more renewables. The plan calls for the further liberalisation of the Turkish energy market, limiting the share of state-owned enterprises. The National Energy Plan 2022 aims to meet the country’s 2053 net-zero emission target. The share of coal in primary energy consumption should be limited to 21.4% by 2035 which would still result in an absolute increase of coal use to 62.7 Mtce with an installed coal plant capacity of 24.3 GW.

Türkiye aims to become a hub in the fossil gas market. The TurkStream pipeline from Russia opened in January 2020 and can carry 31.5 billion cubic metres (bcm) annually, with half destined for the European market. In 2020, Türkiye also imported 11.1 bcm from Azerbaijan via the Trans Anatolian TANAP and Baku-Tbilisi-Erzurum (BTE) pipelines. Newly discovered gas fields in the Black Sea and the Mediterranean Sea could significantly lower Türkiye’s import dependence.

Türkiye ratified the Paris Agreement on 6 October 2021, and its national targets allow an 86% rise in greenhouse gas emissions from 499 MtCO2e in 2020 to 929 MtCO2e in 2030 before falling to net zero by 2053. Through research and development, Türkiye promotes clean coal technologies, CCUS, coal-based chemicals such as ammonia, synthetic diesel and alternative gases. A Hydrogen Technologies Strategy and Roadmap was launched in January 2023.

Hard coal

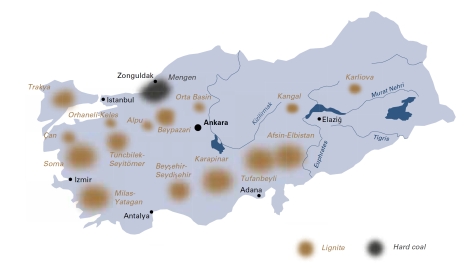

Türkiye’s hard coal deposits are in the Zonguldak basin, between Ereğli and Amasra on the Black Sea coast in northwest Türkiye. Total hard coal resources in the basin are estimated to be over one billion tonnes, of which reserves are estimated to be 550 million tonnes. The calorific value of hard coal reserves varies between 6 200 and 7 200 kcal/kg. This coal basin is the only region in Türkiye where hard coal is extracted and it has a very complex geological structure which makes mechanised coal production difficult; hence, coal production is labour intensive and subsidised.

The state-owned TTK operates five deep mines in the Zonguldak coal basin and produced 1.1 million tonnes of saleable coal in 2022, supplying the 300 MW Catalağzı thermal power plant owned by BEREKET ENERGY and other customers. Including private mines, hard coal production in Türkiye totalled 1.4 million tonnes in 2022. In the same year, Türkiye imported 34.7 million tonnes of hard coal for thermal power plants, steel production, industry and domestic heating purposes – mostly from Colombia and Russia, with smaller quantities from the United States, Australia, Canada and South Africa (Türkiye did not join the EU ban of 2022 on Russian coal imports).

Türkiye has embarked on an ambitious programme to build new power plants with the latest supercritical and circulating fluidised bed (CFB) boiler technologies to burn mainly lignite and imported coal. The second unit at AKSA ENERJI’s 270 MW Bolu-Göynük plant started operation in 2016, while ENERJISA ENERJI completed its 450 MW Tufanbeyli CFB plant in Adana province. Two 700 MW supercritical units at EREN ENERJI’s 2 790 MW ZETES power station were also completed in 2016 at Zonguldak, running on imported coal. Private investment into the Turkish energy sector often includes foreign companies in joint ventures, such as the 1 320 MW İsken-Sugözü coal power plant in partnership with STEAG and the 1 320 MW Emba Hunutlu coal power plant, opened in 2022 as a joint venture with SHANGHAI ELECTRIC POWER. The government intends to increase the share of domestic companies in both the power generation and mining sectors.

Lignite

Lignite is Türkiye’s most important indigenous energy resource, with total resources of 16.3 billion tonnes and 11.0 billion tonnes of reserves. Deposits are spread across the country, the most important one being the Afşin-Elbistan lignite basin of south-eastern Anatolia, near the city of Maraş where deposits are up to 58 metres thick and economic reserves are estimated to be around 7 billion tonnes. The Soma basin is the second-largest lignite mining area in Türkiye. Other exploited deposits are located in: Muğla province with the Yeniköy lignite facility at Ören (Milas) and the South Aegean lignite facility at Yatağan; Kütahya province with the Seyitömer lignite facility at Seyitömer and the Tunçbilek mining centre at Tavşanlı; Çanakkale province with the Çan lignite facility; Bursa province with the Bursa lignite facility at Orhaneli; and Konya province with the Ilgın lignite facility. The quality of Turkish lignite is generally very poor and only around 5.1% of existing reserves have a heat content of more than 3 000 kcal/kg (12 500 kJ/kg).

The scale of Türkiye’s surface mining operations allows lignite to be produced at a relatively low cost, making it competitive with imported energy resources. In 2022, lignite output was 80.9 million tonnes, including from underground mines in the Soma, Tunçbilek and Beypazarı basins. Among the proposed new lignite mines in Türkiye, those in Thrace, Eskişehir-Alpu and Afyon-Dinar would be underground, and those in Konya and Karamanmaraş would be opencast.

The Turkish government promotes more private ownership in the coal-mining sector and encourages domestic coal production by tendering the licences held by public companies for non-producing blocks. Some of these tenders grant the right to mine coal subject to the construction of an adjacent power plant. By 2021, five new licenses were awarded. All coal plants can benefit from capacity payments and voluntary power purchase agreements with EÜAŞ for a proportion of their output if using domestic coal.

Looking to the future, TKİ works in collaboration with TÜBİTAK, the Turkish Scientific and Technical Research Council, and other international partners on research projects in the fields of lignite drying, coal gasification, coal-biomass co‑combustion and liquid fuels production, some projects partly supported by the European Union.

Asphaltite

At Silopi near the Iraqi and Syrian borders, a third CFB unit at CINER GROUP’s 405 MW asphaltite-fired power plant was commissioned in 2015 by CHINA NATIONAL MACHINERY ENGINEERING CORPORATION. In 2022, 1.5 million tonnes of asphaltite were mined. The national institute TurkStat includes asphaltite production data within lignite production.

Türkiye

|

Coal production, reserves and resources |

2022 |

|

|

Hard coal saleable output |

Mt |

1.4 |

|

Hard coal reserves |

Mt |

550 |

|

Hard coal total resources |

Mt |

1 337 |

|

Lignite saleable output |

Mt |

80.9 |

|

Lignite reserves |

Mt |

10 975 |

|

Lignite total resources |

Mt |

16 259 |

|

Saleable coal quality |

|

|

|

Hard coal net calorific value |

kJ/kg |

26 000 ‑ 30 000 |

|

Hard coal ash content |

% a.r. |

10.0 ‑ 15.0 |

|

Hard coal moisture content |

% a.r. |

4.0 ‑ 14.0 |

|

Hard coal sulphur content |

% a.r. |

0.8 ‑ 1.0 |

|

Lignite net calorific value |

kJ/kg |

8 665 |

|

Lignite ash content |

% a.r. |

11.0 ‑ 46.0 |

|

Lignite moisture content |

% a.r. |

6.0 ‑ 55.0 |

|

Lignite sulphur content |

% a.r. |

0.2 ‑ 5.0 |

|

Coal imports / (exports) |

|

2022 |

|

Hard coal |

Mt |

34.7 / (0.7) |

|

Primary energy production |

|

2021 |

|

Total primary energy production |

Mtce |

66.0 |

|

Hard coal production |

Mt / Mtce |

1.2 / 1.0 |

|

Lignite production |

Mt / Mtce |

72.7 / 23.5 |

|

Primary energy consumption |

|

2021 |

|

Total primary energy supply |

Mtce |

227.2 |

|

Hard coal consumption |

Mt / Mtce |

38.1 / 33.9 |

|

Lignite consumption |

Mt / Mtce |

86.5 / 24.2 |

|

Power supply |

|

2022 |

|

Total gross power generation |

TWh |

326.0 |

|

Net power imports (exports) |

TWh |

2.7 |

|

Total power supply |

TWh |

313.9 |

|

Power generation from hard coal |

TWh net |

66.5 |

|

Power generation from lignite |

TWh net |

46.3 |

|

Hard coal power generation capacity * |

MW net |

10 374 |

|

Lignite power generation capacity * |

MW net |

11 437 |

|

Employment |

|

2022 |

|

Direct in hard coal mining |

number |

8 528 |

|

Direct in lignite mining |

number |

44 457 |

* As at December 2022, 67 “coal” power plants were operating in Türkiye: 46 lignite-, 4 hard coal-, one asphaltite-, and 16 imported coal-fired power plants. The capacity of the four power plants using domestic hard coal is included here in the lignite capacity figure.