![]() With its great resource potential, the mining sector is of outstanding importance to Bulgaria and has developed strongly over the last few years, considerably surpassing the labour productivity of other sectors and almost reaching the EU average. Over the last few years, the mining sector has attracted considerable local and foreign investment with several companies investing in world-class exploration, extraction and processing.

With its great resource potential, the mining sector is of outstanding importance to Bulgaria and has developed strongly over the last few years, considerably surpassing the labour productivity of other sectors and almost reaching the EU average. Over the last few years, the mining sector has attracted considerable local and foreign investment with several companies investing in world-class exploration, extraction and processing.

|

General data |

2015 |

|

|

Population |

million |

7.2 |

|

GDP |

€ billion |

45.3 |

Bulgaria has an Energy Strategy to 2020 and there are on‑going discussions on a new medium- to long-term energy strategy post 2020. After finalising its new energy strategy, the government intends to develop a national low-carbon development strategy, continuing on from the Third National Action Plan on Climate Change for the period 2013-2020 that was published in 2012.

Due to its domestic production of coal and nuclear electricity, Bulgaria had an import dependency in 2014 of just 34.5%, this being far below the EU average of 53.5% when all energy products are considered together. At 35.7%, the share of coal in total primary energy supply is twice the EU average while the 23.2% share of nuclear power is around 50% greater than the EU average. Power prices are correspondingly low – among the lowest in the EU. In 2012, eight years early, Bulgaria reached its 2020 target of 16% renewable energy in final energy consumption, but at a high economic and political cost.

The Bulgarian energy sector is relatively small on a global scale, although it is of great significance to the country`s energy-intensive industrial base and accounts for above EU‑average shares in total employment and value added. It includes oil and gas transport to the European market. The sector is of strategic importance to the economic development of the country and to national energy security, which to some extent explains the large investments in new capacity, rehabilitation of old power plants and expansion of the power supply grid made over recent years. New projects will see more gas and electricity interconnectors with Greece, Romania, Serbia and Turkey. However, the regulated end-consumer tariffs are not sufficient to match the investment costs borne by electricity utilities, a situation exacerbated by the high number of consumers in arrears.

The liberalisation of the electricity and gas markets in Bulgaria is being carried out in line with the requirements of EU legislation. In practice, this is a step-by-step process with the aim of creating the necessary conditions for competition, such as giving consumers the opportunity to choose their supplier.

By providing jobs to highly qualified and experienced specialists, the mining sector contributes to the social and economic development and welfare of the mining municipalities. Unfortunately, the long permitting procedures from an initial investment assessment to exploration and the lack of clear regulations on extraction and planning are impeding the industry’s development. Nevertheless, there are good prospects for the introduction of the best new technologies from Europe and around the world in order to further enhance efficiency in the fields of extraction and processing.

The major tasks of the Bulgarian mining industry are the sustainable development of the mining regions, environmental protection and land restoration, improvement of work safety standards and enhanced vocational training.

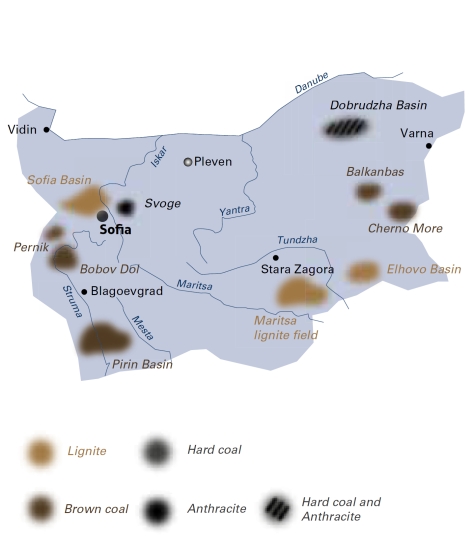

Lignite

Opencast lignite mining is mainly carried out in the mines of MINI MARITSA IZTOK EAD (MMI) whose production accounted for 90% of the country’s total in 2015. Its mines cover an area of some 240 square kilometres, being the largest mining site in South East Europe. MMI is also the biggest employer in Bulgaria. The company supplies four power plants with its own lignite: the state-owned Maritsa East 2 thermal power plant (TPP) (1 620 MW) and the privately owned CONTOURGLOBAL Maritsa Iztok East 3 TPP (908 MW), AES Galabovo TPP (670 MW) and BRIKELL TPP (200 MW). MMI also supplies lignite to the 120 MW Maritsa 3 TPP in Dimitrovgrad.

As a subsidiary of BULGARIAN ENERGY HOLDING, MMI plays an important role in ensuring national energy security and guaranteeing Bulgaria’s energy independence; 40% of the country’s electricity is generated from lignite supplied by MMI.

Other smaller lignite mining companies operate Beli Bryag mine (1.9% of national lignite production in 2015), Stanyantsi mine (2.4%) and Chukurovo mine (0.2%).

Brown coal

Bulgaria’s brown coal deposits are mostly located in the western part of the country (Bobov Dol, Pernik and Pirin coalfields and the Katrishte deposit) and near the Black Sea (Cherno More coalfield). In 2015, the production of brown coal from both underground and surface mines totalled 2.1 million tonnes.

VAGLEDOBIV BOBOV DOL EOOD mines in the Bobov Dol coalfield, being the largest deposit of brown coal in the country with reserves and resources amounting to some 100 million tonnes. Coal from the single opencast mine and two underground mines is supplied mainly to the nearby 210 MW Bobov Dol TPP. In 2015, a total of 1.0 million tonnes of brown coal was produced from the three mines. About 10% to 12% of the coal mined by VAGLEDOBIV BOBOV DOL is used by households.

OTKRIT VAGLEDOBIV MINES EAD, another private company, owns two opencast mines in the Pernik coalfield where it extracted 1.0 million tonnes of brown coal in 2015.

BALKAN MK OOD carries out underground coal mining in the Oranovo coalfield with some 30 million tonnes of brown coal reserves and a production capacity of 0.7 million tonnes per year. The brown coal is supplied mainly to Bobov Dol TPP.

Other small privately owned mines are the Vitren mine located in the Katrishte deposit, with an annual capacity of around 0.1 million tonnes, and Cherno More mine in the Black Sea coalfield, with an annual capacity of 0.25‑0.3 million tonnes.

Hard coal

Hard coal output is not significant (35 thousand tonnes) and its extraction is carried out by MINA BALKAN 2000 EAD.

Bulgaria

|

Coal resources and reserves |

||

|

Resources brown coal |

Mt |

320 |

|

Resources lignite |

Mt |

4 300 |

|

Reserves brown coal |

Mt |

190 |

|

Reserves lignite |

Mt |

950 |

|

Primary energy production |

2015 |

|

|

Total primary energy production* |

Mtce |

15.6 |

|

Brown coal and lignite (saleable) |

Mt / Mtce |

35.9 / 8.4 |

|

Saleable coal quality |

||

|

Brown coal calorific value |

kJ/kg |

12 140‑13 400 |

|

Lignite calorific value |

kJ/kg |

5 652‑7 746 |

|

Brown coal ash content |

% a.r. |

<26 |

|

Lignite ash content |

% a.r. |

17‑45 |

|

Brown coal moisture content |

% a.r. |

<16 |

|

Lignite moisture content |

% a.r. |

51‑60 |

|

Brown coal sulphur content |

% a.r. |

<2.7 |

|

Lignite sulphur content |

% a.r. |

2.2‑2.8 |

|

Coal imports / exports |

2015 |

|

|

Hard coal imports |

Mt |

1.1 |

|

Primary energy consumption |

2015 |

|

|

Total primary energy consumption* |

Mtce |

25.4 |

|

Coal consumption |

Mtce |

9.8 |

|

Power supply |

2015 |

|

|

Total gross power generation |

TWh |

48.4 |

|

Net power imports (exports) |

TWh |

(10.4) |

|

Total power consumption |

TWh |

38.0 |

|

Power generation from lignite |

TWh |

18.8 |

|

Power generation from hard coal |

TWh |

1.0 |

|

Lignite and brown coal power generation capacity |

MW |

4 199 |

|

Hard coal generation capacity |

MW |

708 |

|

Employment |

2015 |

|

|

Direct in brown coal & lignite mining |

thousand |

11.765 |

|

Other brown coal- & lignite-related** |

thousand |

46.851 |

* 2014 data

** e.g. in power generation, equipment supply, services and R&D