![]() Germany has considerable reserves of hard coal and lignite, making these the country’s most important indigenous sources of energy. However, in the case of hard coal, there remain only approximately 20 million tonnes to be extracted following the political decision to end subsidised German hard coal production in 2018. For lignite, there are long-term prospects for about 5 billion tonnes of mineable reserves in existing and approved surface mines.

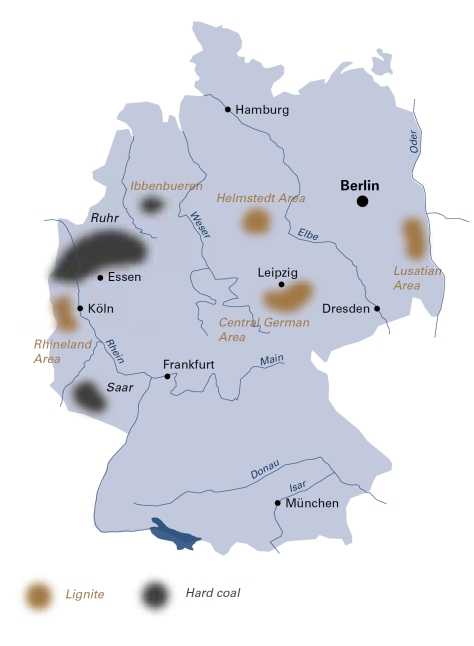

Germany has considerable reserves of hard coal and lignite, making these the country’s most important indigenous sources of energy. However, in the case of hard coal, there remain only approximately 20 million tonnes to be extracted following the political decision to end subsidised German hard coal production in 2018. For lignite, there are long-term prospects for about 5 billion tonnes of mineable reserves in existing and approved surface mines.

|

General data |

|

2015 |

|

Population |

million |

81.2 |

|

GDP |

€ billion |

3 032.8 |

In 2015, primary energy production totalled 139.6 Mtce, excluding nuclear power. With an output of 61.3 Mtce, coal and lignite had a share of 43.9%. The mix of indigenous primary energy production excluding nuclear power can be broken down as follows: 54.9 Mtce of lignite (39.3%), 6.4 Mtce of hard coal (4.6%), 8.9 Mtce of natural gas (6.4%), 3.5 Mtce of oil (2.5%) and 57.7 Mtce of renewable energy (41.3%) and other fuels 7.9 Mtce (5.6%).

Germany’s primary energy consumption amounted to 453.6 Mtce in 2015. Oil accounted for the largest share (33.6%), followed by coal (24.7%), natural gas (21.1%) and nuclear energy (7.5%). Renewable energy sources grew to 12.5%. Within the figure for coal, hard coal accounted for 12.9% and lignite for 11.8% of total primary energy consumption. Germany is dependent on energy imports to a large extent, except in the cases of lignite and renewable energy. About 90% of hard coal was imported, in comparison with 98% import dependence for oil and 90% for natural gas.

The power generation structure is characterised by a widely diversified energy mix. In 2015, gross power generation output of 646.5 TWh was produced as follows: 42.1% from coal (of which 23.9% was from lignite and 18.2% from hard coal), 14.2% from nuclear, 9.5% from natural gas, 29.0% from renewable energy sources and 5.2% from other sources. Thus, hard coal and lignite, along with nuclear power, are still the mainstays of the German power industry.

The federal government adopted its Energiekonzept (energy plan) in October 2010. At this time, it assumed life extensions of German nuclear power plants up to the late 2030s. In 2011, after the Fukushima incident, it was decided to phase out nuclear power generation in Germany by the end of 2022. From the beginning, the focus has been on ambitious climate protection policies: a greenhouse gas emission reduction of 80% to 95% by 2050 with step-by-step objectives for each decade, including a 40% reduction by 2020 (compared with 1990); a massive increase in energy efficiency to yield total energy savings of 20% by 2020 and 50% by 2050; and the steady development of renewables to a 60% share of final energy consumption and 80% of power consumption by 2050. Thus, Germany’s climate protection targets go beyond EU targets. In order to achieve the 2020 CO2-reduction target, the German government decided in 2015 to implement a “Climate Action Programme 2020” (Aktionsprogramm Klimaschutz 2020)). This includes specific measures for the electricity sector which will have a direct impact on the use of lignite and hard coal. In November 2016, the German federal government also agreed upon a “Climate Protection Plan 2050” (Klimaschutzplan 2050) which sets out strategies to reduce greenhouse gas emissions by 61% to 62% by 2030 compared with 1990. The plan was presented at the UNFCCC COP 22 meeting in Marrakesh and means a move away from EU-wide efforts towards national climate action. However, up to now, there are no concrete actions concerning coal.

Since 2011, the German government and parliament have decided on a package of several new or amended energy laws and further political measures to foster change in the energy sector. This long-term and fundamental change is known as the Energiewende or “energy transition” to renewable energy.

In practice, coal-fired power plants will be needed to compensate for the phase out of nuclear power and, in the long term, to balance the ever-increasing power generation from renewables. Subsidised hard coal production is to be phased out by 2018, but imported hard coal will play a considerable role, because of a large and quite modern power plant portfolio. Coal – hard coal and lignite – is one of the pillars to ensure security during the transition process and is acknowledged as helpful by federal states and the German government.

In response to the rising cost of the Energiewende, a reform of the Erneuerbare-Energien-Gesetz (EEG – German Renewable Energy Act) was made in 2014 and a ten-point energy agenda outlined by the new Federal Ministry of Economic Affairs and Energy to ensure that the Energiewende becomes a success story. Currently, the main challenges are to control costs by introducing limits to the expansion of onshore and offshore wind power and solar PV, as well as a move to auctioning in place of fixed feed-in tariffs. A major question is grid expansion, which is far behind schedule and quite expensive. Electricity market design is also under discussion, taking into account regional co‑operation within the EU and broader international markets. Due to the EEG subsidy for renewable power and the decline in coal and CO2-certificate prices, wholesale electricity prices have fallen to very low levels in Germany and while coal is still needed to guarantee security of supply, more and more coal-fired power plants can no longer operate profitably. This has led to closure notifications being submitted to the grid agency (Bundesnetzagentur) covering a total capacity of 12.2 GW. Nineteen (2.9 GW) of the sixty-nine notified power plants cannot be closed for supply security reasons, thus underlining the importance of coal-fired power plants.

In the view of the coal industry, the transition process of the German power sector is a long-term task up to 2050. During these three to four decades, many steps have to be taken to maintain a secure and affordable power supply while reducing CO2 emissions and introducing new, but currently unknown technologies. Comprehensive impact assessments as well as coherence with EU climate policy are indispensable when deciding on specific future climate actions at the national level.

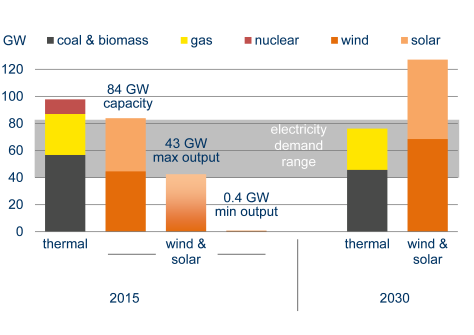

Flexible and ever-available power generation capacity is becoming short and even shorter because of the phase out of nuclear power and the policy-driven closures of old hard coal-, lignite- and gas-fired power plants. The forecast to 2035 of the German network regulatory authority shows that the power system will be based on fully available coal- and gas-fired capacities, on the one hand, and fast-growing wind and solar PV capacities on the other hand.

As long as there is no large-scale storage solution for electricity, a combination of power systems will be needed to match the ups and downs of wind and solar PV generation and so balance supply and demand, because renewable power can be close to zero at times and low for several months.

Two systems, one task: security of supply: In 2015, German electricity demand was met by two systems: a reliable thermal one mainly based on coal and a new renewables one with a widely varying output. Under an approved plan for electricity network development, Scenario A (2017 to 2030) shows the continued growth of renewable energy sources.

Coal-fired power plants can manage this task and contribute to a successful energy transition.

Hard coal

In 2015, the German hard coal market amounted to 57.7 Mtce, of which 38.8 Mtce were used for power and heat generation, while 17.6 Mtce were consumed by the steel industry. The remaining 1.3 Mtce were sold to the residential heating market.

At 55.5 million tonnes, Germany was the EU’s largest hard coal importer in 2015 (43.2 million tonnes steam coal and 12.3 million tonnes coking coal). The most important sources of imported coal were Russia and other CIS countries with a market share of 29.0%, followed by Colombia, the United States, Australia, Poland and South Africa.

The German government is phasing out – in a socially acceptable manner – all state aid for coal production by 2018. Hence, restructuring of the hard coal industry continues such that there are only two operating mines, namely the Prosper-Haniel colliery located in the Ruhr area and another deep mine near Ibbenbüren, both owned by RAG DEUTSCHE STEINKOHLE (RAG), formerly RUHRKOHLE AG. In 2015, RAG produced 6.7 million tonnes of saleable hard coal.

Employment figures continue to fall steadily. The number of employees in the hard coal mining sector decreased during 2015 by 20.4% from 12 104 to 9 640.

In 2007 and 2008, the formal separation of RAG’s so-called “white” business was completed and the new EVONIK INDUSTRIES AG was created. In April 2013, EVONIK, with its commercial activities in the fields of chemicals, energy and property, was listed on the Frankfurt and Luxembourg stock exchanges.

The core business of RAG remains hard coal mining with certain related activities, especially in the fields of real estate in mining areas (RAG MONTAN IMMOBILIEN), coal trading (RAG VERKAUF) and mining consultancy (RAG MINING SOLUTIONS).

The private RAG Foundation, created in July 2007, is the owner of RAG and majority owner of EVONIK. Continuing liabilities after the final phase-out of hard coal mining (i.e. mine water management) will be financed by the proceeds of the Foundation. Using its assets, the Foundation will also promote education, science and culture in the mining regions.

Brown coal and lignite

Lignite supply in 2015 totalled 55.0 Mtce of predominantly domestic production (lignite imports were an insignificant 47 thousand tonnes). Exports of pulverised lignite and briquettes amounted to 1.4 Mtce.

Lignite production, which totalled 178.1 million tonnes (54.9 Mtce) in 2015, was centred in four mining areas, namely the Rhenish mining area around Cologne, Aachen and Mönchengladbach, the Lusatian mining area in south-eastern Brandenburg and north-eastern Saxony, the Central German mining area in the south-east of Saxony-Anhalt and in north-west Saxony as well as the Helmstedt mining area in Lower Saxony. In these four mining areas, lignite is exclusively extracted at opencast mines. In 2015, a total of 887.8 m3 of overburden were moved during mining – an average overburden-to-coal ratio of 5.0 cubic metres per tonne.

Nearly 90% of lignite production is used for power generation (159.3 million tonnes in 2015), accounting for 23.9% of total power generation in Germany. As a part of the “Climate Action Programme 2020”, on 1 July 2015, national political leaders, trade unions and the power plant operators jointly agreed that 2 700 MW of lignite-fired power generation capacity would be gradually transferred into a security standby reserve, starting in October 2016 and ending in October 2023. These plants will remain on standby for a period of four years after which they will be closed. This will result in a reduction in lignite demand of about 21 million tonnes by 2019, reducing annual emissions by 21 MtCO2.

In the Rhineland, RWE POWER AG produced a total of 95.2 million tonnes of lignite in 2015 from its three opencast mines: Hambach, Garzweiler and Inden. Almost 90% of the lignite was consumed at the company’s own power stations, whilst some 10.6 million tonnes were used for processed products. At the end of 2015, the Rhenish mining area had a total workforce of 9 410.

The lignite mining plan for the third resettlement section of the Garzweiler mine was officially approved on 29 October 2015. This will be the last resettlement as declared by the state government of North Rhine Westphalia in its guideline decision on the future of the Rhenish lignite-mining area and Garzweiler II on 5 July 2016. According to this guideline decision, the planned further resettlements for Garzweiler in the 2030s are to be dropped. The stipulations made mean a significant downsizing of the already approved extraction field at the Garzweiler opencast mine, along with the loss of several hundred million tonnes of lignite. However, it is to be most welcome that the government also confirmed the need for the Garzweiler mine in the period after 2030 without time limitation and for the Inden and Hambach opencast mines within their approved mining boundaries. This gives general planning security for the Rhenish lignite mining area, although the Garzweiler mining plan has had to be scaled down.

The generation capacity of RWE POWER consists of lignite-fired power plants with a total capacity of 10 296 MW (net). At Neurath, two new lignite-fired units with optimised plant technology (BoA 2/3) were commissioned in August 2012 with a gross capacity of 2 200 MW to replace several old plants. Lignite-fired power output in the Rhenish lignite mining area amounted to some 78.4 TWh in 2015. The preparation of approval licenses for a new 1 100 MW BoAplus unit to replace four existing 300 MW units commenced in late March 2015 – after the municipal and regional planning procedures had been completed. This was followed later in the year by early public consultation meetings. With an efficiency of over 45%, BoAplus with optimised plant technology will set a new world record for lignite-based power generation, emitting about 30% less CO2 compared with the existing 300 MW units which will be decommissioned.

Five of RWE’s 300 MW units will be transferred to the security standby reserve. This will result in a CO2 emission reduction of about 15% in the Rhineland. In the following decade from 2020 to 2030, there will be additional options for reducing CO2 emissions by increasing efficiency and reducing load at all plants in times when enough renewable power production is available. By around 2030, the Weisweiler power plant will be decommissioned, because of the scheduled depletion of the Inden opencast mine. Total CO2 emissions from lignite will thereby be reduced by 40% to 50% in total as early as about 2030. The use of lignite in the Rhineland is therefore in line with the overall climate protection targets. Depending on the further expansion of renewable energy after 2030, the power plant capacity can be further reduced until electricity is supplied exclusively by modern BoA units, at least until the Garzweiler and Hambach opencast mines are depleted around the middle of the century.

In the Lusatian mining region, the Czech-owned LAUSITZ ENERGIE BERGBAU AG (branded LEAG) is the only producer following the acquisition of VATTENFALL’s assets in October 2016. With total lignite output of 62.5 million tonnes in 2015, LEAG extracts lignite at Jänschwalde and Welzow-Süd in Brandenburg, as well as at Nochten and Reichwalde in Saxony. The Cottbus Nord mine closed in late 2015.

Lignite sales to power plants in Lusatia amounted to 58.8 million tonnes in 2015. LAUSITZ ENERGIE KRAFTWERKE AG (also branded LEAG) is the main operator of lignite-fired power plants in the mining area with a total gross capacity of 7 175 MW (net), including Jänschwalde, Schwarze Pumpe and Boxberg power plants. In 2015, the gross power output from these plants totalled 55.6 TWh. At the end of 2015, the Lusatian mining area had a total workforce of 8 316.

The Central German mining area around Leipzig yielded a total lignite output of 18.9 million tonnes in 2015. The most important company in this area is MITTELDEUTSCHE BRAUNKOHLENGESELLSCHAFT mbH (MIBRAG), owner of two opencast mines at Profen in Saxony Anhalt and Schleenhain in Saxony. The company supplies lignite to its two combined heat and power plants at Deuben and Wählitz with a total capacity of 123 MW as well as to the larger LEAG/ENBW Lippendorf and UNIPER Schkopau power stations. With a total capacity of 2 900 MW (net), these plants generated 19.0 TWh in 2015. At the end of 2015, the Central German mining area had a total workforce of 2 565.

In January 2014, MIBRAG acquired HELMSTEDTER REVIER GmbH, owner and operator of the Schöningen opencast lignite mine in the Helmstedt mining area and the adjacent 352 MW (net) Buschhaus power plant which generated 2.5 TWh in 2015. The mine was closed in late 2016, because the power plant was transferred to the security standby reserve, HELMSTEDTER REVIER had a total workforce of 453.

Another opencast mine in the Central German mining area is operated by ROMONTA at Amsdorf in Saxony-Anhalt. A third of a million tonnes of lignite were mined in 2015 and processed to extract raw lignite wax. The wax-free fuel is used for power generation at Amsdorf.

It is clear that the coal industry, with its capital investments, operating expenditures and payment of salaries, makes a very substantial contribution to the German economy. A study by the EEFA research institute analysed the employment created by the German lignite industry. According to this study, for each direct job in the lignite industry, another 2.5 jobs are created at companies who supply equipment and services.

Extraction of lignite from opencast mines changes the natural landscape, so land reclamation is an integral part of any mining project. Mining activities are only complete following the transformation of a former “industrial” opencast mine into a vibrant landscape. For more than one hundred years, nature has inspired landscape restoration projects in Germany, including indigenous flora and fauna. Projects that return land to productive use, often with a high recreational and agricultural value, are most typical.

Germany

|

Coal resources and reserves |

|

|

|

Total resources hard coal |

Mt |

82 959 |

|

Total resources lignite |

Mt |

72 700 |

|

Reserves hard coal |

Mt |

2 500 |

|

Reserves lignite |

Mt |

36 200 |

|

Primary energy production |

|

2015 |

|

Total primary energy production |

Mtce |

172.0 |

|

Hard coal (saleable output) |

Mt / Mtce |

6.7 / 6.4 |

|

Lignite (saleable output) |

Mt / Mtce |

178.1 / 54.9 |

|

Saleable coal quality |

|

|

|

Hard coal net calorific value |

kJ/kg |

30 264 |

|

Lignite net calorific value |

kJ/kg |

7 800‑11 500 |

|

Hard coal ash content |

% a.r. |

3.3‑21.0 |

|

Lignite ash content |

% a.r. |

2.5‑20.0 |

|

Hard coal moisture content |

% a.r. |

2.5‑13.0 |

|

Lignite moisture content |

% a.r. |

40.0‑61.5 |

|

Hard coal sulphur content |

% a.r. |

0.45‑1.8 |

|

Lignite sulphur content |

% a.r. |

0.12‑2.5 |

|

Coal imports / exports |

|

2015 |

|

Hard coal imports |

Mt |

55.5 |

|

Hard coal exports |

Mt |

0.1 |

|

Primary energy consumption |

|

2015 |

|

Total primary energy consumption |

Mtce |

453.6 |

|

Hard coal consumption |

Mtce |

58.6 |

|

Lignite consumption |

Mtce |

53.4 |

|

Power supply |

|

2015 |

|

Total gross power generation |

TWh |

646.5 |

|

Net power imports (exports) |

TWh |

(51.8) |

|

Total power consumption |

TWh |

594.7 |

|

Power generation from hard coal |

TWh |

117.7 |

|

Power generation from lignite |

TWh |

154.5 |

|

Hard coal power generation capacity |

MW net |

28 224 |

|

Lignite power generation capacity |

MW net |

21 002 |

|

Employment |

|

2015 |

|

Direct in hard coal mining |

thousand |

9.640 |

|

Direct in lignite mining |

thousand |

15.428 |

|

Other hard coal-related* |

thousand |

15.700 |

|

Other lignite-related* |

thousand |

5.316 |

* e.g. in power generation, equipment supply, services and R&D